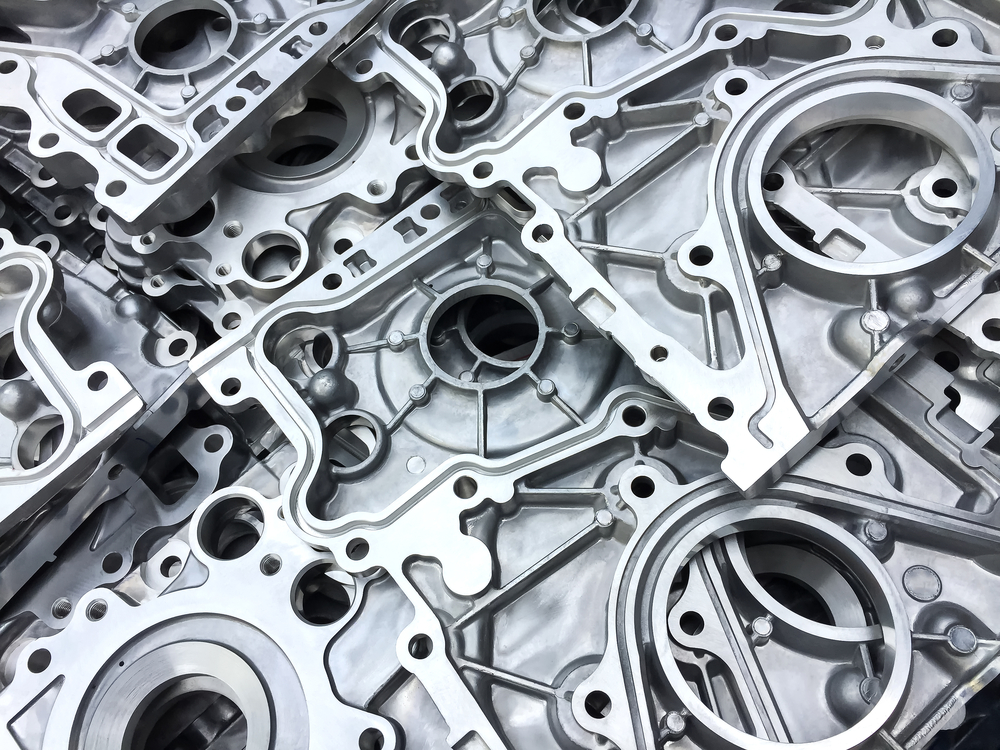

Our policy is built to mitigate the unique risk profile of today's manufacturers

Explore CFC's specialized solution:

Manufacturer's professional

Manufacturer’s professional combines E&O alongside optional cyber coverage, to ensure manufacturing businesses aren’t left exposed.

Highlights

- Comprehensive professional liability cover

- Affirmative coverage for technology errors

- Cyber, privacy and cybercrime

Get in touch

- Elena Luck

- US Professions Development Manager

- Richard Farrow

- US Professions Team Leader

- Kelby Warner

- US Professions Underwriting Manager

- Stella Gilson

- US Professions Underwriter

- Pawel Grubecki

- US Professions Underwriter

- Christian Hemmant

- US Professions Underwriter

- Ashleigh Hyde

- US Professions Underwriter

Manufacturer's professional claims examples

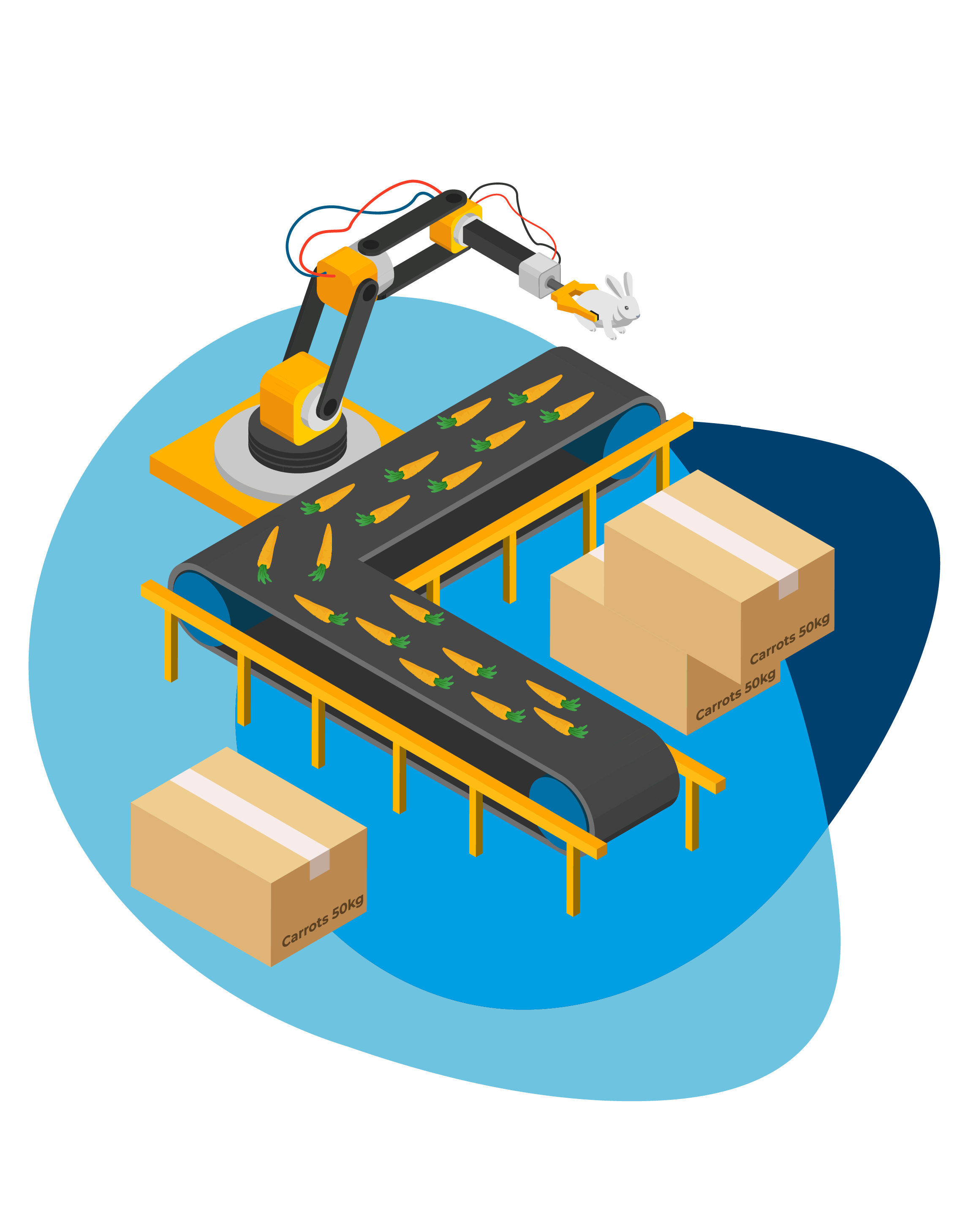

When it comes to insuring their business, manufacturers often believe a professional liability is not required because their exposure to errors & omissions (E&O) is low. However, this is not the case. Take a look at some of our claims examples to understand how CFC’s manufacturer's professional policy comes into action.

Products failing to perform

A manufacturer of components for automation equipment ran into trouble when a batch of 1,000 components sent to a client was found to be 0.1mm off in size due to inaccurate machine settings. As a result, the components couldn’t be used, and a new batch had to be produced. This caused delays in the client’s project, leading to financial losses as they couldn’t meet their own obligations.

The client blamed the insured for the issue, and the insured’s policy responded to cover the losses caused by the manufacturing error, as it was an unintentional mistake.

Errors & omissions

A producer of plastic widgets for the automotive industry sent 5,000 widgets to a client for dashboard production. Unfortunately, the widgets didn’t fit due to an accidental size adjustment of 0.5mm. This prevented the car manufacturer from meeting its production deadline. As a result, the client sued the insured for lost revenue and expenses.

The insured’s policy responds to the claim, as the claim is caused by an error in the manufacturing process.

Ancillary professional service

The insured manufactures 6” cogs for mechanical equipment. During routine maintenance, an operative accidentally adjusted the machine to produce 5.95” cogs. The error wasn’t noticed by either the insured or the client, and the cogs were dispatched as usual. When the client attempted to use the cogs, they realized the size error, rendering the batch unusable.

The client pursued the insured for losses associated with the incorrect calibration of the machine. The insured’s policy responded to the claim, as the claim related to an ancillary professional service performed by the insured.

Pollution incident

A manufacturer of plastic bottles suitable for hazardous chemicals found itself facing a claim after a client reported some bottles were found leaking in the warehouse. An investigation revealed the issue was caused by a reaction between the bottle contents and a new bonding glue used in the bottle manufacturing process, weakening the bottles.

The client pursued the insured for the losses, and the insured’s policy responded, as the leak was due to an issue in the manufacturing process.

Media liability

The insured manufactures children’s lunchboxes featuring popular characters. After renewing a licensing agreement, the insured mistakenly believed it covered all franchises from a prominent media outlet. They released a new range featuring a well-known superhero, which led to a cease-and-desist letter for unauthorized use of the trademark. The distributor brought the issue to the insured, who had incorrectly assumed the agreement covered both cartoon and superhero characters.

The policy responded to defend the claim, resolving the matter with the insured extending their licensing agreement.

Book a session

Our experts want to hear from you. Get answers to any questions you might have, no matter how specific, by booking a one-on-one session here.

FAQs

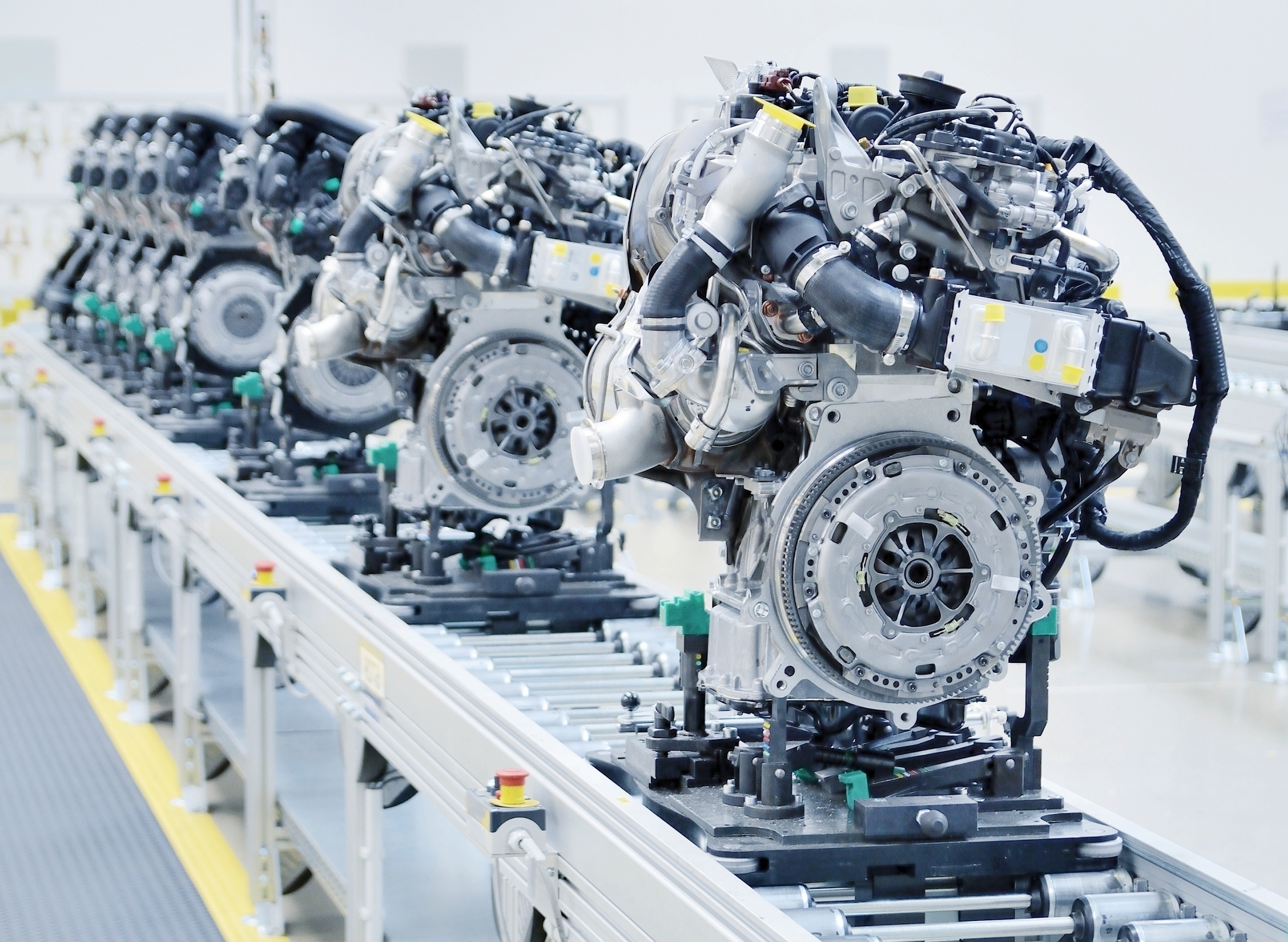

How is manufacturer’s professional different from general liability insurance?

General and products liability covers third-party claims for bodily injury or property damage caused by a product but doesn’t cover product repair, replacement or consequential losses.

Manufacturer's professional (E&O) insurance fills this gap, covering third-party financial losses due to a product’s failure to perform, whether caused by manufacturing errors or defective materials, offering broader protection for manufacturers.

Who needs manufacturer's professional?

This insurance is typically recommended for any manufacturers, especially those who additionally provide professional services such as design, engineering or consulting.

At CFC we consider a broad range of manufacturers. Please feel free to get in touch if you have any questions.

What are the limits of coverage?

CFC offers high-quality coverage at competitive rates. We can consider up to $5m E&O limits on our manufacturer’s professional product, depending on size, business activities and other factors.