Products

By integrating Solution expertise with CFC’s global capabilities, we’re unlocking new levels of insight, impact and value for our brokers—and their clients. Underwriting is entering an exciting new era, moving beyond the linear process of quoting and issuing policies. Here’s a faster, smarter way to protect businesses from the unexpected.

Financial lines

Financial lines, also known as professional indemnity insurance, is essential for businesses of all sizes and industries. It provides crucial protection against legal expenses, damages and financial liabilities - helping businesses stay resilient in the face of unexpected challenges.

Key features

- Full civil liability cover

- Continuous cover

- IP rights infringement, general liability, and management liability cover

Casualty

Casualty insurance protects businesses against financial loss from a wide range of claims including bodily injury and property damage. It’s essential coverage for companies of all sizes.

We provide comprehensive general liability coverage for a wide range of industries, on both a primary and excess of loss basis. Backed by a highly experienced team, our policies help businesses stay protected against unexpected risks and liabilities.

Key features

- Personal injury and property damage

- Product liability

- Errors & omissions (E&O)

- Principals' indemnity

- Goods in care custody control

Accident & health

Accident and health insurance covers a range of accidents and medical emergencies. This not only safeguards individuals on a personal level but also reinforces a business’s commitment to employee safety and well-being.

Our range of tailored accident and health policies offer essential protection for customers domiciled in Australia, backed by a highly experienced team that understands the risks and challenges they face. With comprehensive coverage and expert support, let’s help businesses and individuals stay prepared for the unexpected.

Key features

- Unlimited medical expenses

- Private leisure travel for directors and senior staff

- Cover for financial default

- Cover for COVID-19

Legal protection

Legal protection insurance provides businesses with access to professional legal advice and covers the costs of pursuing or defending claims—helping to manage the financial risks of litigation.

Our coverage ensures businesses can seek legal recourse or defense without the burden of high legal costs. With access to professional legal support across a wide range of business matters, companies can focus on their operations with confidence and peace of mind.

Key features

- Access to free legal advice

- Defense and pursuit cover

- Broad appetite

Meet the team

Our team is a dynamic blend of insurance industry experts and fresh-eyed innovators, bringing diverse perspectives and ground-breaking ideas from their respective fields across Melbourne, Sydney, Brisbane, and Perth.

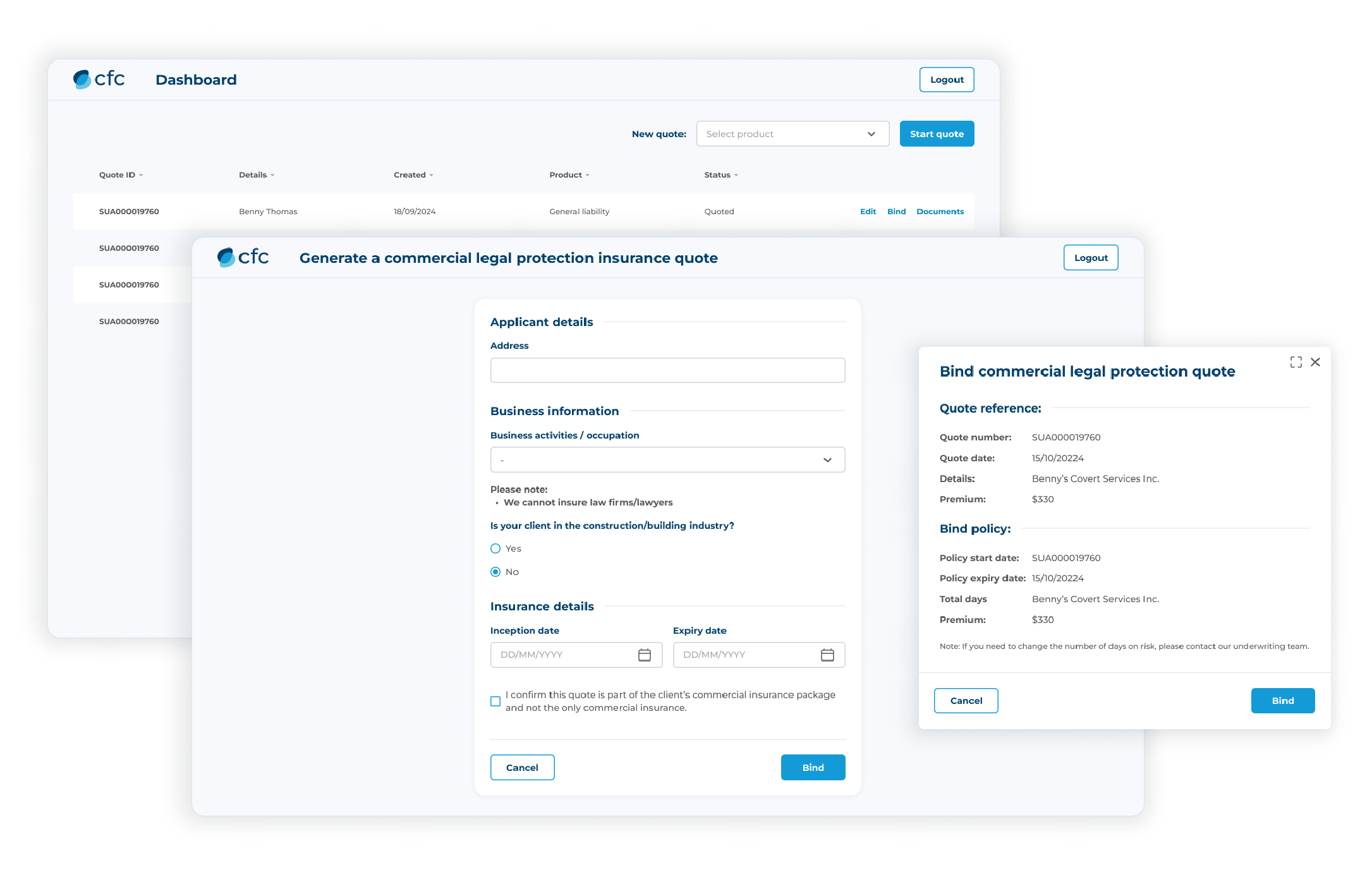

Digital applications

Generate

Quote, bind and issue policy documents for a large range of professional indemnity occupations in minutes. Higher commission, lower policy fees and pre-populated forms - let's make your life easier.

Access Generate here https://generate.cfc.com/ or to request a login, simply email brokersupport.au@cfc.com.

Travel assistance app

The Travel Assistance app offers features such as 24/7 emergency assistance with reverse charge calls, access to key travel websites, a travel wallet checklist to store important documents, and personalized details like policy number and company name. It also reminds clients to contact their brokers for policy-related matters.

The app is available for free on the App Store and Google Play. For questions, email a&h@cfc.com.

How to trade with us

The Solution Underwriting insurance products are still available in the same way you’ve always been used to trading them just now to CFC Australia. But if you’d like to trade CFC UK products via the CFC Australia team, there may be some differences in trading and tax implications which you’ll need to be aware of. We understand this might raise questions, so we’ve created a flowchart to guide you through.

View flowchart

Claims

From the moment you make a claim, your dedicated claims adjuster will proactively assist you in managing the process from start to finish. We prioritize speed and simplicity in our claims handling, ensuring you can quickly return to focusing on what matters most.

Contact claims nowFAQs

Who are we?

With 14+ years in the Australian market, Solution – now CFC Australia – has built a strong reputation among brokers, supporting small and mid-sized businesses across Melbourne, Sydney, Brisbane, and Perth.

The partnership with CFC opens new opportunities to offer innovative products. As a market leader in cyber and emerging risks, CFC combines advanced technology and data science to provide smarter, faster underwriting. With over two decades of experience, CFC remains Australia’s top choice for cyber insurance, now offering even greater protection with an expanded regional presence.

Will there be any implications for existing policies?

Despite the rebrand, there will be no changes to existing policies. The existing business you have with Solution will be traded in exactly the same way, ensuring a seamless experience as we bring our portfolios together.

Are there any changes to Solution Underwriting’s bank accounts?

The bank accounts are now in the name of CFC Underwriting Pty Ltd, however the BSB and Account Number for each bank account remain unchanged.

How can I access the Generate platform?

Access to the Generate platform remains unchanged. To log in, you will still need an account. Simply click here to request a login, and you’ll receive the details via email within 24 hours.

When logging in for the first time, you'll be prompted to set up a password and complete multi-factor authentication to ensure the safety of both your information and your clients.

Are all products available to Australian brokers?

In joining Solution and CFC together we are committed to delivering optionality for our brokers. You will now have access to new product lines including cyber, transaction liability, management liability and tech E&O.

What is the process for filing a claim?

The process starts when the broker submits the claim to the claims team inbox. The claim is then sent to the insurer or claims administrator. After that, an acknowledgment is quickly sent to the broker to confirm that the claim has been sent. The insurer also sends an acknowledgment to the broker with their contact details and the claim number. All further communication from the broker goes through the designated channel.

How can I contact someone for assistance or inquiries?

A complete list of our team members across all Australian offices can be found here.

What career opportunities are available in Australia?

With offices in Melbourne, Sydney, Brisbane, and Perth, our teams combine innovation and expertise to protect small and mid-sized businesses with top-tier insurance. As Australia’s leading cyber insurance provider, we’re expanding to support businesses in specialist insurance and emerging risks. Our high-performing, collaborative team is passionate about doing insurance differently. To find out more, click here.